In today’s fast-paced world, ensuring the security of business premises is more critical than ever. With the rise in theft, vandalism, and cyber threats, investing in a robust security system has become a necessity for both offices and retail stores. This article will explore the essential features that every business security system should include, ensuring a safe environment for employees and customers alike.

Understanding Business Security Systems

Business security systems are designed to protect physical assets, sensitive information, and personnel. They encompass a range of technologies and strategies aimed at preventing unauthorised access, theft, and damage. Understanding the components of these systems is crucial for selecting the right solution for any business.

Types of Security Systems

There are several types of security systems available, each serving different purposes. These include surveillance cameras, alarm systems, access control systems, and cybersecurity measures. The right combination of these elements will depend on the specific needs and vulnerabilities of the business.

For instance, a retail store may benefit significantly from a comprehensive CCTV system to monitor customer behaviour and deter shoplifting, while an office might prioritise access control systems to manage employee entry and protect sensitive information. Additionally, integrating smart technology into these systems can enhance their effectiveness; for example, smart alarms can send real-time alerts to business owners’ smartphones, allowing for immediate action in case of a security breach.

Importance of Customisation

Every business is unique, and so are its security needs. Customisation of security systems allows businesses to address their specific vulnerabilities effectively. A thorough risk assessment can help identify potential threats and inform the selection of appropriate security measures.

Moreover, customisation ensures that businesses are not overspending on unnecessary features while still maintaining a high level of security. Consulting with security professionals can provide valuable insights into the most effective solutions tailored to individual circumstances. For instance, a company operating in a high-crime area may require more robust measures, such as motion detectors and reinforced entry points, whereas a business in a low-risk environment might opt for basic surveillance and alarm systems. This tailored approach not only optimises security but also instils confidence among employees and customers, knowing that their safety is a priority.

Essential Features of Business Security Systems

When considering a business security system, certain features are indispensable. These features not only enhance security but also contribute to the overall efficiency and safety of the workplace.

Surveillance Cameras

Surveillance cameras are a cornerstone of any effective security system. They provide real-time monitoring and can deter criminal activity simply by being visible. Modern CCTV systems offer high-definition video quality, night vision capabilities, and remote access through mobile applications.

Additionally, many systems come equipped with motion detection and alert features, notifying business owners of any unusual activity. This proactive approach enables swift responses to potential threats, minimising damage and loss.

Alarm Systems

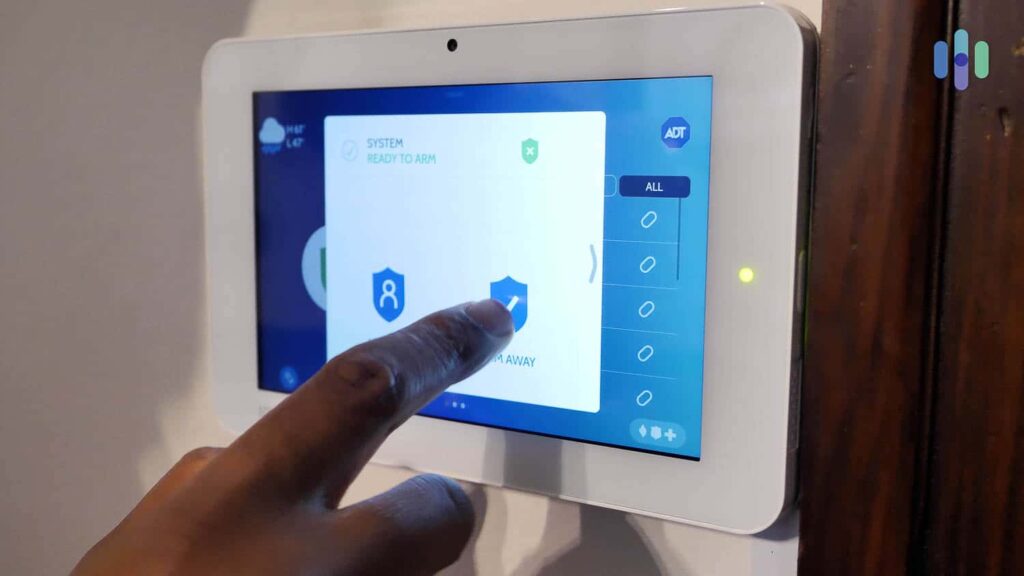

Alarm systems serve as an essential line of defence against intrusions. A well-designed alarm system will include door and window sensors, motion detectors, and panic buttons. These components work together to alert business owners and law enforcement in the event of a breach.

Moreover, integrating alarm systems with surveillance cameras can enhance security further. For example, if an alarm is triggered, the associated camera can automatically begin recording, providing crucial evidence for investigations.

Access Control Systems

Access control systems are vital for managing who can enter specific areas of a business. These systems can range from simple keycard access to biometric scanners that read fingerprints or facial recognition. By limiting access to authorised personnel, businesses can protect sensitive information and assets.

Furthermore, access control systems can be programmed to log entries and exits, providing a detailed account of who accessed certain areas and when. This feature can be invaluable for investigating incidents or ensuring compliance with security policies.

Integrating Cybersecurity Measures

In an increasingly digital world, cybersecurity is an integral part of business security. Protecting sensitive data from cyber threats is as crucial as physical security measures. A comprehensive security strategy should encompass both physical and digital protections.

Data Encryption

Data encryption is a fundamental aspect of cybersecurity. It ensures that sensitive information, such as customer data and financial records, is unreadable to unauthorised users. Implementing strong encryption protocols can significantly reduce the risk of data breaches.

Moreover, businesses should regularly update their encryption methods to keep pace with evolving cyber threats. This proactive approach demonstrates a commitment to safeguarding customer information and maintaining trust.

Regular Security Audits

Conducting regular security audits is essential for identifying vulnerabilities within both physical and digital security systems. These audits can reveal weaknesses in existing protocols and highlight areas for improvement. Learn more about security alarm monitoring: how it can reduce false alarms and improve safety.

By regularly assessing security measures, businesses can adapt to changing threats and ensure that their systems remain effective. Engaging with cybersecurity experts can provide additional insights and recommendations for enhancing security practices.

Employee Training and Awareness

Even the most sophisticated security systems can be undermined by human error. Therefore, employee training and awareness are critical components of a comprehensive security strategy. Ensuring that all staff members understand security protocols can significantly reduce risks.

Creating a Security Culture

Establishing a culture of security within the workplace encourages employees to take an active role in protecting the business. Regular training sessions can educate staff on recognising potential threats, such as phishing emails or suspicious behaviour.

Moreover, fostering open communication about security concerns allows employees to report issues without fear of repercussions. This proactive approach can lead to quicker responses to potential threats and a more secure environment overall.

Emergency Response Plans

Having a well-defined emergency response plan is crucial for addressing security incidents effectively. Employees should be familiar with procedures for various scenarios, such as theft, fire, or cyber-attacks.

Regular drills and updates to the emergency response plan will ensure that all staff members are prepared to act swiftly and efficiently in the event of a security breach. This preparedness can mitigate damage and protect both employees and customers.

Choosing the Right Security Provider

Selecting a reputable security provider is essential for implementing an effective security system. The right provider will offer not only quality products but also ongoing support and expertise.

Evaluating Security Providers

When evaluating potential security providers, businesses should consider factors such as experience, customer reviews, and the range of services offered. A provider with a proven track record in the industry will likely have the knowledge and resources to meet specific security needs.

Additionally, it is beneficial to seek out providers who offer customised solutions tailored to the unique requirements of the business. This level of service ensures that the security system is both effective and efficient.

Ongoing Support and Maintenance

Security systems require regular maintenance and updates to remain effective. A reliable security provider will offer ongoing support, including system upgrades and troubleshooting assistance. This commitment to service ensures that businesses can adapt to new threats and maintain a high level of security.

Conclusion

Investing in a comprehensive business security system is a critical step for any office or store. By incorporating essential features such as surveillance cameras, alarm systems, and access control, businesses can create a secure environment for their employees and customers. Additionally, integrating cybersecurity measures and fostering a culture of security among staff further enhances protection.

Ultimately, choosing the right security provider and remaining vigilant through regular audits and training can significantly mitigate risks. In a world where security threats are ever-evolving, proactive measures are essential for safeguarding business assets and ensuring peace of mind.